Introduction

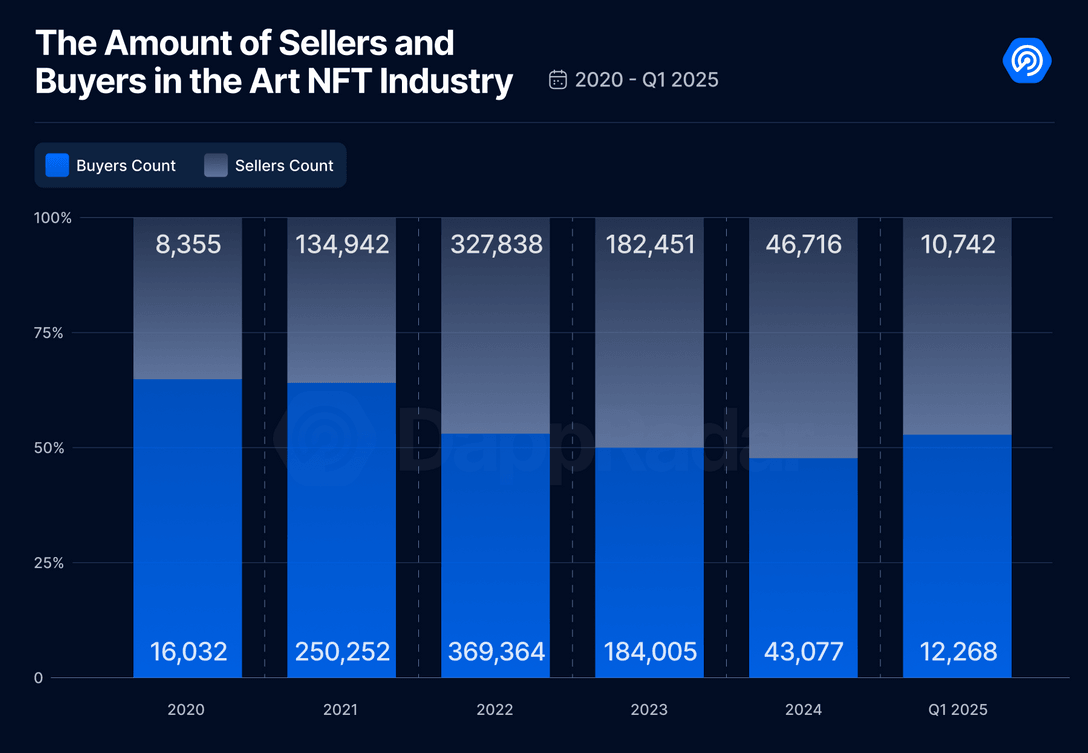

The non-fungible token (NFT) market has experienced a catastrophic crash, with valuations plummeting 90% from their 2022 peak. This dramatic downturn has left investors reeling and raised fundamental questions about the future of digital collectibles. Our in-depth investigation reveals the complex factors behind this collapse and what it means for blockchain’s cultural experiment.

A. The Staggering Decline in Numbers

1. Market Performance Metrics

- Trading volume dropped from 17billion(Jan2022)to1.7 billion (2023)

- Average sale price fell from 6,900to412

- 95% of NFTs now worthless versus mint price

2. Platform Contractions

- OpenSea layoffs: 50% staff reduction

- LooksRare trading volume down 99.5%

- Magic Eden pivoting to gaming NFTs

3. Celebrity NFT Failures

- Justin Bieber’s 1.3millionBoredApenowworth59,000

- Snoop Dogg’s collection lost 92% value

- Paris Hilton NFT project abandoned

B. Root Causes of the Collapse

1. Economic Factors

- Crypto winter freezing speculative investments

- Rising interest rates killing risk appetite

- Recession fears prioritizing essentials

2. Structural NFT Problems

- No intrinsic valuation models

- Copyright confusion (rights vs tokens)

- Infinite reproducibility paradox

3. Cultural Shifts

- “JPEG fatigue” setting in

- Environmental concerns gaining traction

- Scam fatigue (over $100M in NFT frauds)

C. The Survivors and Adaptors

1. NFT Categories Still Thriving

- Gaming utility NFTs (5% market growth)

- Music royalty NFTs (steady 12% monthly volume)

- Ticketing NFTs (adopted by 40+ sports teams)

2. Enterprise Pivots

- Nike’s .SWOOSH collecting $185M

- Tiffany’s CryptoPunk pendants ($50K each)

- Starbucks Odyssey rewards program

3. Technological Evolutions

- Dynamic NFTs with updatable metadata

- Fractionalized high-value assets

- DeFi-NFT hybrid models

D. Lessons From the Boom and Bust

1. Investor Takeaways

- Speculative bubbles follow predictable patterns

- Diversification matters in crypto

- Utility beats hype long-term

2. Creator Realizations

- Community building > quick flips

- Real-world value propositions win

- Sustainable models needed

3. Platform Adjustments

- Focus shifting to enterprise clients

- Emphasizing blockchain utilities

- Implementing better safeguards

E. The Road Ahead for NFTs

1. Short-Term (2024)

- Continued consolidation

- More regulatory scrutiny

- Institutional experiments

2. Medium-Term (2025-2027)

- Mature valuation frameworks

- Mainstream utility adoption

- Interoperability standards

3. Long-Term (2028+)

- Digital/physical asset convergence

- AI-generated NFT ecosystems

- New ownership paradigms

Conclusion

The NFT market collapse represents a necessary correction rather than a complete failure. While speculative mania has evaporated, the underlying technology continues evolving toward practical applications. The next chapter of NFTs will likely focus less on cartoon apes and more on verifiable ownership solutions for digital and physical assets alike.

Tags: NFT crash, digital collectibles, blockchain, crypto winter, NFT market, Web3, digital art, cryptocurrency, NFT future, NFT utility

Category: Finance & Technology