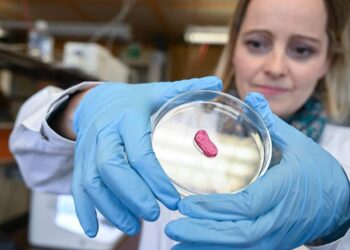

The food industry is undergoing a revolutionary transformation as cultivated meat makes its historic debut in supermarkets. Singapore’s 2020 approval of Eat Just’s lab-grown chicken marked the beginning of a new era in sustainable protein. This 2,500-word deep dive explores how scientists are turning stem cells into steaks, the environmental benefits of this breakthrough, and what consumers can expect as this technology goes mainstream.

The Science Behind Cultivated Meat

A. The Production Process

-

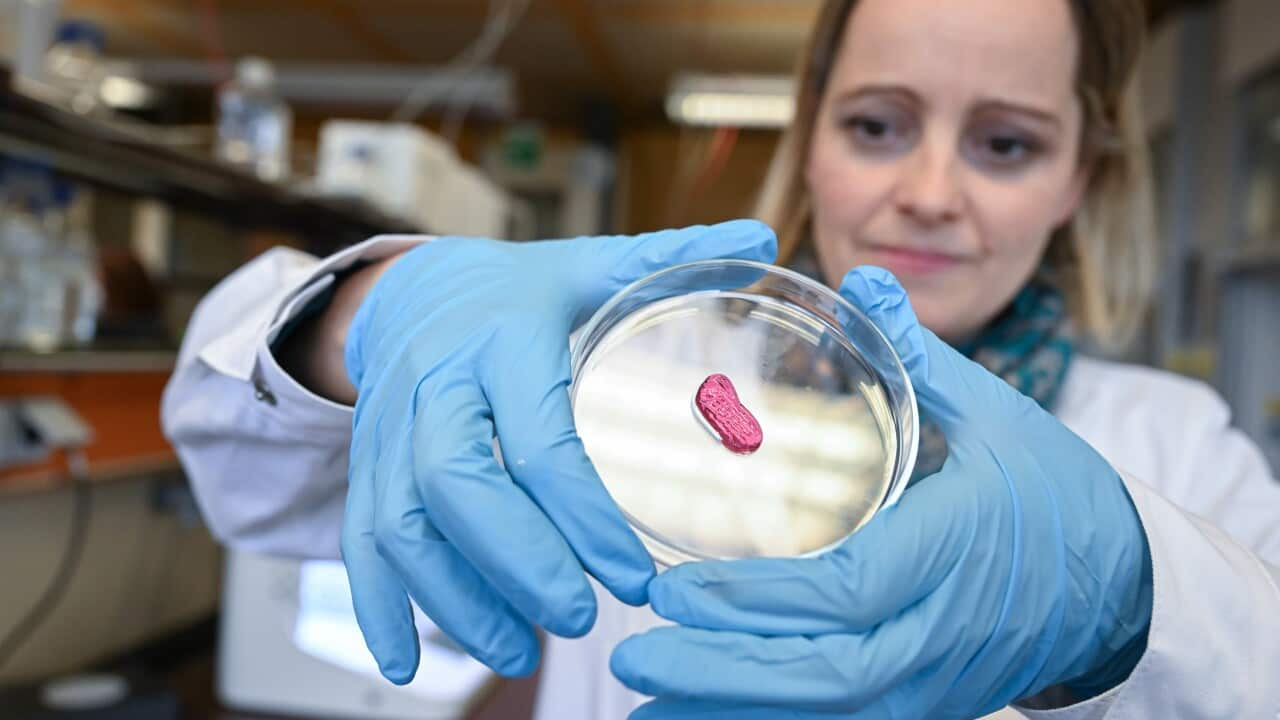

Cell Selection: Stem cells harvested from animals via painless biopsy

-

Proliferation: Cells multiplied in nutrient-rich bioreactors

-

Differentiation: Cells transformed into muscle, fat, and connective tissue

-

Structuring: 3D printing and scaffolding create meat textures

-

Harvesting: Final product ready for packaging

B. Key Technological Breakthroughs

-

Serum-free growth media development

-

Cost reductions from 330,000to11 per burger since 2013

-

Scalable bioreactor designs

Global Market Rollout Status

| Country | Company | Product | Availability |

|---|---|---|---|

| Singapore | Eat Just | Chicken Nuggets | Select restaurants |

| USA | Upside Foods | Cultivated Chicken | Limited release |

| Israel | Aleph Farms | Thin-Cut Beef | Coming 2024 |

| Netherlands | Mosa Meat | Beef Burgers | Pending EU approval |

Environmental Impact Analysis

A. Resource Savings vs Conventional Meat

-

96% lower greenhouse gas emissions

-

45% less energy required

-

99% reduced land use

-

96% decreased water consumption

B. Climate Change Mitigation

Potential to reduce agricultural emissions by 14.5% if replacing 50% of conventional meat

Consumer Acceptance Factors

A. Taste Test Results

Blind trials show:

-

70% cannot distinguish from conventional meat

-

15% prefer cultivated version

-

10% detect slight texture differences

B. Price Comparison Timeline

-

2023: 300% premium

-

2025: Projected 50% premium

-

2030: Expected price parity

C. Regulatory Hurdles

Current approval processes in:

-

FDA/USDA joint oversight (USA)

-

European Food Safety Authority

-

Singapore Food Agency

Investment and Industry Growth

$2.8 billion invested since 2016 with:

-

150+ startups worldwide

-

35 pilot production facilities

-

Major backing from Cargill, Tyson, and Leonardo DiCaprio

Future Projections

-

2025: 1% global meat market share

-

2030: 10% market penetration

-

2035: Potential mainstream adoption